How to Use Commerce Control Center (Business Track)

There are a lot of merchants out there, including myself, who have run into the Commerce Control Center and wondered what it is and what it does. In fact, there’s a decent chance you were using it already, under a different name: Business Track.

What is this platform, what does it do, and how do you use it?

Since the system and the documentation are kind of a mess, I wanted to give it a thorough rundown.

What is the Commerce Control Center (Business Track)?

Commerce Control Center is the new official name of the suite of tools formerly known as the Business Track. It’s officially run by the Fiserv Corporation, and still uses the businesstrack.com address, despite the new name.

Many people knew of Business Track with additional names, such as Wells Fargo, or under the name of the biggest tool in it, ClientLine. This stems from the product’s origin as a co-produced product made by Fiserv and Wells Fargo, a partnership that ended this year. As a result, Fiserv has chosen to change the name of the product to distance itself from the Wells Fargo branding.

Billed as a control room for operations, the Commerce Control Center is essentially a dashboard where you can access various tools you may need as part of your business operations. It gives you a wealth of reporting options, and also serves as a messaging hub for disputes and chargebacks, as well as other services.

Many businesses across the country use Commerce Control Center, so it’s worth knowing what it can do and how to use it if you’re looking to join them.

What Can the Commerce Control Center Do for Your Business?

There are two major features in the Commerce Control Center.

The first is reporting. Commerce Control Center has over 150 different types of reports, ranging from simple 7-day rolling transaction summaries to niche reports on transaction velocity changes and bank deposit reporting. All of these are accessible either as live reports online through the tool, or as scheduled reports delivered to you via email.

Most businesses tend to identify a handful of reports they find valuable and set them to be delivered on a regular basis, which gives you insights without overwhelming you with often unnecessary detail. The reports you aren’t using can still be viewed, but they don’t clutter up your email or burden you with the increased cognitive load of information you don’t need.

The second aspect of the platform is dispute management. This half of the Commerce Control Center will alert you when there’s an event in your dispute and reconciliation process, including when a dispute is filed, when a new message is received, and when an investigation is closed.

As part of the dispute management app, you can receive disputes, view the details of the dispute, and respond to chargebacks directly from the portal. Whether you’re proving a transaction was legitimate, offering a refund for reconciliation, or ceding the dispute and processing the chargeback, you can do it all from that one location.

Other features are also worked into the Commerce Control Center as well, though they don’t take center stage. Such features include:

- Merchant Onboarding, which is more for the payment processors to set up a process to onboard new merchants into the system.

- Virtual POS, which is a web application allowing merchants to handle electronic payments through systems like telephone, mail order, or fax.

- General account management features, like creating additional merchant accounts and managing access.

- Transaction controls and are a suite of tools including various transaction settings, verification restrictions, and fraud filters.

- Hosted Checkout Configurator, which allows merchants to set up custom hosted checkout processes based on their needs.

All of this is more or less built to be a universal control center for financial transactions, though it’s somewhat barebones compared to what some other processing dashboards allow these days.

How to Make Use of the Commerce Control Center

If your financial institution as a merchant uses the Commerce Control Center, you’re going to want to familiarize yourself with it to make use of its features. Otherwise you’re going to be hampered by needing to use other tools over the top of it, while accomplishing many of the same tasks.

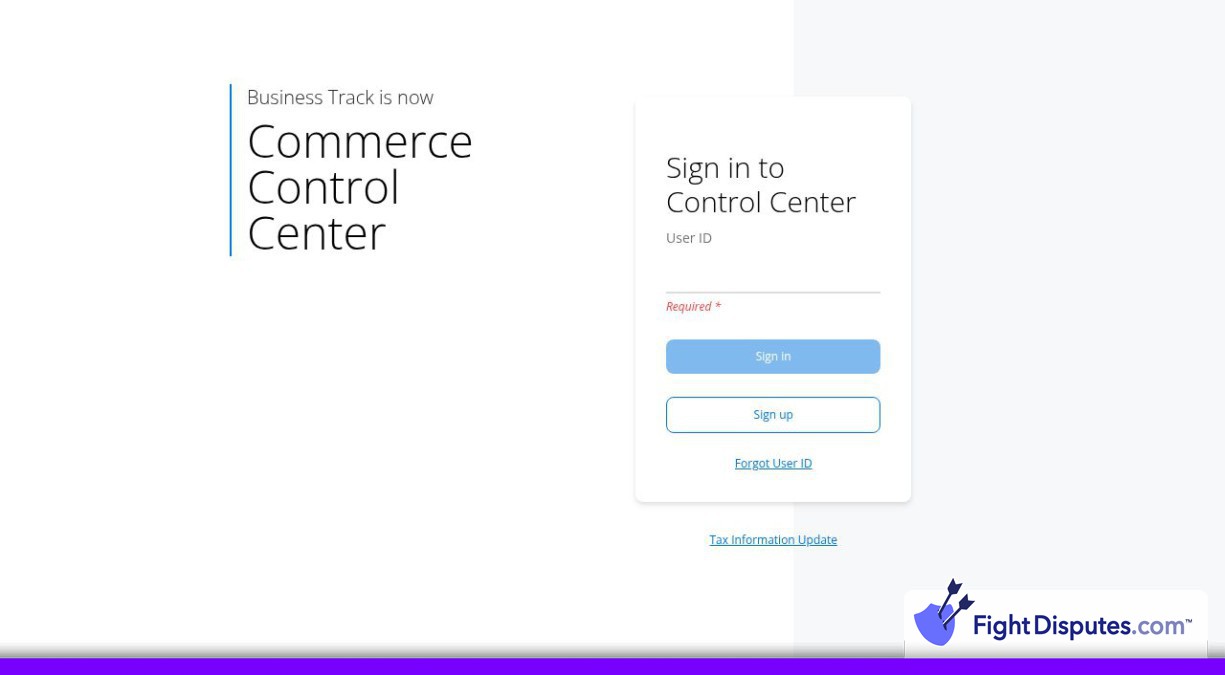

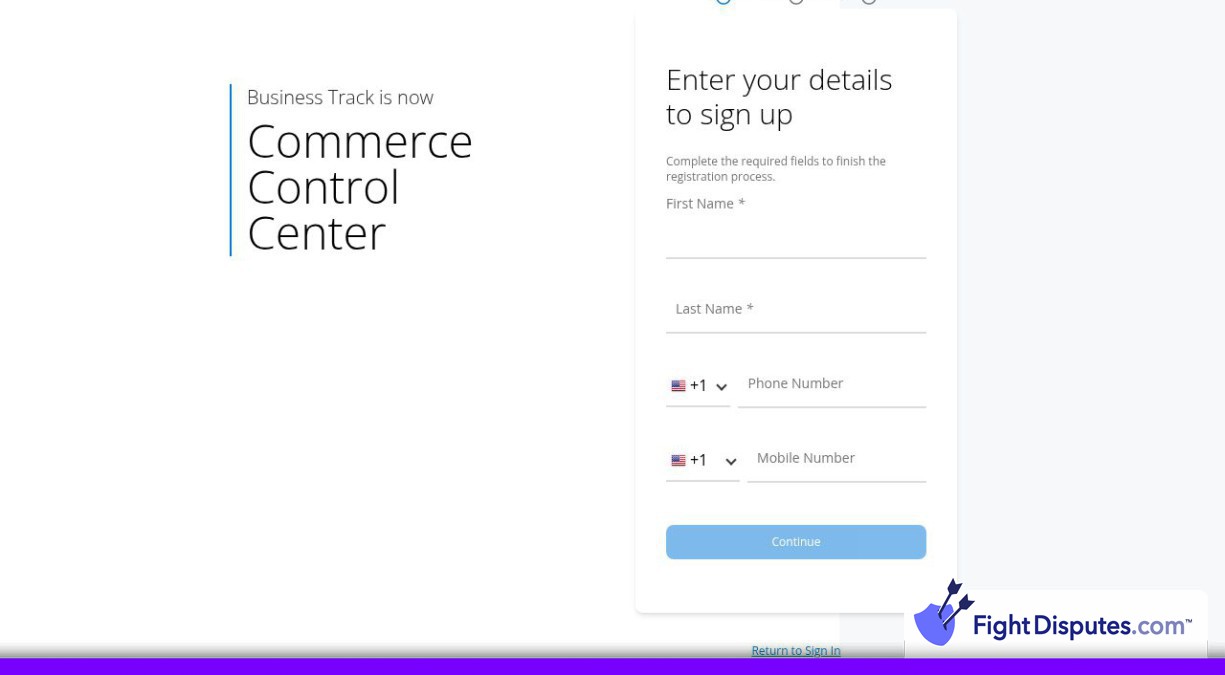

The first step is to make sure you’re signed up and have a valid account. As a merchant, you can’t just go to Fiserv’s website and register; you need to work with your financial institution to have a merchant account set up for you, and then configure it to meet your needs.

Once your account is set up, I recommend exploring it just to see what exists and where to find it. There’s a lot to explore, and not a lot of public documentation, so it pays to do some digging. If you have any questions, you can also ask your account representative, who will be able to guide you through the experience.

If your financial institution uses the onboarding system, they will likely have a guided experience or set of modules that can help you familiarize yourself with the system. This can also help you through the initial setup, but they aren’t always configured well to meet your needs, so don’t be afraid to ask questions along the way.

One thing you might be required to do is set up the passkey system. The Commerce Control Center passkey system is a security tool meant to help you minimize the need to sign on using username and password combinations, while also improving security over traditional multi-factor authentication methods. Once you set it up, you’ll be able to use a passkey or a key device like a TouchID or FaceID system to sign in instead of the normal method.

Once all of those details are out of the way, you should start looking into reports to see what reporting might be most useful for your business. Different kinds of businesses can make use of different kinds of reports. For example, Commerce Control Center can report on transactions handled through a marketplace like Amazon, once you’ve set it up; this report can be extremely useful if you sell through Amazon and your own website, but if you don’t sell through Amazon, it’s not useful.

Next up, configure your fraud prevention rules. While the options aren’t quite as good as those in Authorize.net (in my view) they still give you a lot of useful options to fight fraud, including various geographic restrictions, transaction velocity limitations, and other tools.

You won’t get these aligned perfectly right away, but that’s fine. Having something set up is better than nothing, and you can refine them later to reduce fraud or friction, whichever way they go.

Finally, set up alerts. Alerts will send you notifications if anything trips a fraud filter, if there are any disputes or chargebacks, and if anything changes in your reports. You can also set up certain reports to be emailed to you regularly.

All of this, when configured properly, allows you to ideally never (or very rarely) need to sign into Commerce Control Center directly. You’ll only need to sign in when there’s a dispute that needs handling.

What Are the Problems with the Commerce Control Center?

I’ve alluded to it a couple of times so far, but I’m not a huge fan of the Commerce Control Center. There are a couple of issues that make it frustrating to use, and don’t have clean resolutions.

The biggest issue I have is just friction with using the platform. If you have a merchant account with any of the financial institutions that use the Commerce Control Center (or Business Track, if they haven’t changed their name internally), this is your hub for anti-fraud tools, reporting, and dispute resolution.

That means every time you get a dispute or chargeback, you need to sign into this platform to view it and respond to it. There’s no way to do so through a secondary app or through email, even if all the information you would need to know is sent to you as part of the alert.

So, what’s the big deal? Of course you have to sign into a platform to use it, right?

Well, there’s a lot of friction in signing in, in the name of security. You need to sign in so you can set up a passkey. But the passkey only works as long as your authentication is valid. That’s fine if you sign in every day, but if you only sign in when you need to (like most merchants will), your authentication will likely have expired and you’ll need to sign back in again.

On top of that, passwords have an enforced 180-day maximum duration. You end up needing to change your password at least twice per year. While it’s a good thing to periodically change passwords, being forced to change them is a point of friction that leads to use of less secure passwords. Even governments are starting to stop enforcing changing passwords.

If you’re doing things right and have good fraud detection and a low rate of chargebacks, that effectively means every time you get an alert, you have to go through the tedious process of resetting your password and reauthenticating before you can even see the dispute.

All of that is just a hassle. It would be tedious and annoying but ignorable if the platform under it was excellent, but it’s really just “decent” in my view. The reporting is fairly robust but it’s all very user-unfriendly and requires a lot of proactive exploration to get things set up the way that works best for you.

Unfortunately, since the only real way around it all is to switch to a financial institution that doesn’t use the Commerce Control Center, your options are fairly limited, so it’s something we just need to deal with.

Should You Use Dispute Manager Automation?

One of the big features of the Commerce Control Center Dispute Manager is automation. Specifically, they have a system that allows you to automate the dispute process, including messaging, how to handle chargebacks and retrievals, and how to handle reporting on it all.

I don’t recommend it. There’s a pretty good chance that if someone is filing a chargeback, and it’s not an instance of intentional fraud, they’ve already been with your customer service and have walked away dissatisfied.

If they then confront another automated system, you really aren’t going to get a positive outcome.

Instead, you should consider using the Fight Disputes system. I built this system because there was nothing quite like it, and I found the need to handle disputes in a more effective manner. I think you’ll benefit from it to.

How does it work?

- A customer, for one reason or another, files a dispute with a charge with their bank.

- My connections to the payment processor systems detect the incoming dispute and notify you immediately. We catch and hold the dispute before your bank gets it, and give you an opportunity to resolve the issue.

- You can choose to investigate and provide proof of fraud to have the chargeback denied, or you can reach out to the customer. If the chargeback is legitimate and customer service has failed, you can offer a refund instead.

- If the customer accepts, a refund can be issued and their money returned just like if a chargeback were to happen. The dispute is cancelled and no chargeback happens.

Since chargebacks are dangerous to a merchant account and can get you locked into higher fees or even get your account closed, it’s important to avoid them whenever possible. By catching disputes before they land, we help you do that.

If all of that sounds like a lot of work, and you wish you could automate it, we can handle it for you as well. Instead of relying on a flowchart-based chat bot or an exploitable AI agent, use our managed replies system, where our team handles the communications for you, quickly and professionally.

In my view, anything that can help you avoid having to deal with the Commerce Control Center is ideal, so if you share my view, drop me a line and let’s get you started.

Call (844) NO-DISPUTES

Call (844) NO-DISPUTES