What is Credit Card Authorization?

Credit card authorization is when your payment system double-checks that a customer actually has money in their account and they’re using their own card. The whole verification happens in maybe 2-3 seconds while your processor communicates with their bank and then you either get the green light or it gets declined.

I worked with a retailer who was running an ancient terminal that let them bypass authorization – they had about $8,000 in bad transactions over just two months. Some older systems still let you run cards without checking first.

When a customer swipes or inserts a card, your processor connects with the card network and asks the customer’s bank a few questions – is there enough credit available, is the card still active, does anything look suspicious. Then you get back either an approval code or a decline message that tells you why it didn’t go through. Anyone running a busy shop probably processes these authorizations all day long without thinking about it.

Authorization doesn’t mean you’re completely protected from chargebacks. A customer could buy something legitimately and then three months down the road claim they never got it or say they don’t know the charge on their statement. But for most merchants, the presence of that authorization tends to stop maybe 40% of the chargebacks that would otherwise happen – mostly the ones from maxed-out cards, expired cards, or when someone’s trying to use a card that’s been reported stolen.

Your payment processor probably runs authorizations without you having to think about it. There’s quite a bit happening behind the scenes – fraud detection systems look at thousands of spending patterns.

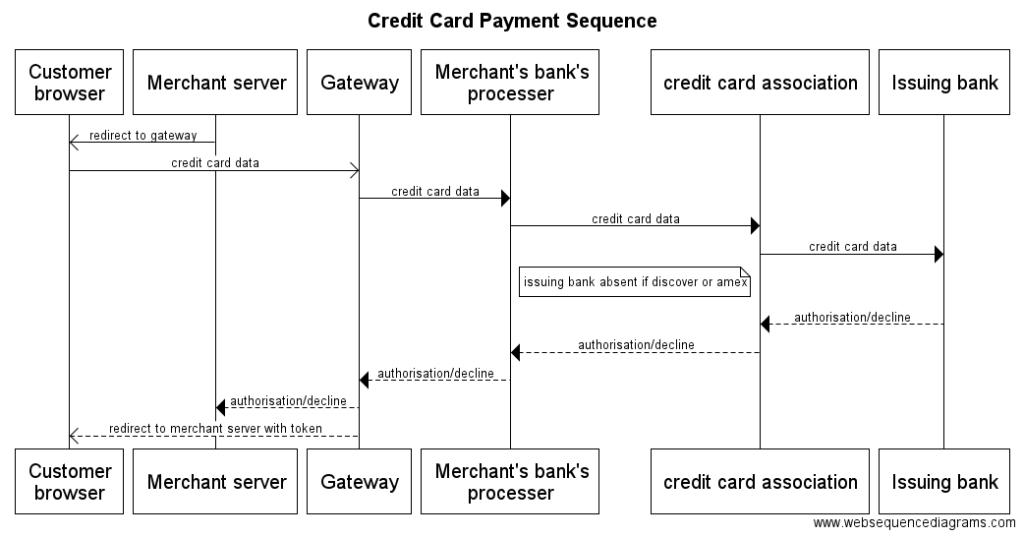

How It Works

When a customer swipes their card, the whole authorization dance happens in maybe 2-3 seconds. Your payment processor bundles up everything about that transaction and shoots it through the card networks until it hits the customer’s bank. The bank checks if they have the money and runs it through their fraud systems. Then you’ll either get back an approval with an authorization code or they’ll decline it and tell you why.

Behind the scenes, your processor sends over the card information – the number, when it expires, that CVV code, their billing address and how much they’re spending. The bank that issued the card looks at all this and compares it to what they have on file. They’re also watching for anything that seems off – maybe this person never shops online and suddenly they’re buying three laptops or their billing address just changed yesterday.

The bank checks whether this is actually the cardholder and whether they have enough money. Once you get that authorization code back, hang onto it. I’ve seen a lot of merchants lose disputes because they couldn’t produce these codes. That code is the bank saying “yes – we approved this exact transaction at this exact time.” But here’s something merchants don’t always know – the money doesn’t actually move yet. The bank just puts a hold on it in the customer’s account. The financial movement happens later when everything settles in batches, usually overnight.

Some patterns almost always show fraud. If the billing address doesn’t match but the CVV does, that’s usually a person who has the card number but not the physical card. Or you’ll see these small test transactions (like three $1 charges) then boom they try for $500. Geographic patterns are pretty obvious too. Nobody’s buying coffee in Miami at 2 PM and then groceries in Seattle at 3 PM. The banks have become extremely skilled at catching velocity patterns – if a card suddenly does ten transactions in five minutes or you see the exact same dollar amount hitting different merchants or a customer who only shops locally suddenly starts buying from merchants in Eastern Europe.

How it Affects Chargeback Prevention

Card processors verify funds and account status with banks in real time. I’ve seen how this catches problems before they turn into bigger issues – with declined transactions and disputed charges eating into revenue.

The authorization itself is your backup when transactions go sideways. Say a customer comes back later and claims they never made that payment – you have the bank’s approval right there from when it happened. From what merchants report, a valid authorization code really helps with dispute cases – makes you something like two-thirds more likely to win.

Chargebacks show up with different reason codes, and authorization takes the worst ones off the table. With documented approval from the bank, they can’t come back saying the transaction wasn’t authorized or there were insufficient funds.

You can layer on extra verification too – methods like matching the CVV and checking billing info. Some legitimate customers might bail when they fat-finger their info on their phones – maybe a couple percent. But merchants who do these tighter controls see dramatically fewer chargebacks. That means that they won’t bleed money on dispute fees every month.

Common Scenarios

Run an online shop and you’ll have card fraud sooner or later. I’ve seen it happen – a person gets hold of a stolen card, places an order and you ship it out. You think everything’s fine. Then a month goes by and the cardholder notices the charge and disputes it. The best defense is to check the CVV code and confirm the billing address actually matches what’s on file. A fraudster who can’t enter that three-digit code or uses some random address will see their payment rejected. Sometimes a legitimate customer mistypes their zip code and gets frustrated. But it beats being hit with chargebacks that run into the thousands.

Restaurants have their own weird situation with tips. You charge the card for the meal. But then there’s the tip. A client who runs a few locations pre-authorizes about 20% extra on top of the bill – it gives enough cushion for most tips without making the customer’s bank think something suspicious is happening. A separate tip charge processed later makes customers see two transactions and start calling to complain.

With subscription businesses, the biggest headache comes from expired or replaced cards. It’s not that you can’t process payments – the old card info just stops working. There’s this setup where you can get authorization tokens that automatically update when banks issue new cards. Your customer gets a replacement card and their monthly payment keeps going through like nothing happened. Otherwise you’re losing customers who actually wanted to keep their subscription but never get around to updating their card information.

Requirements & Timeframes

Credit card authorizations stay active anywhere from a week to a month based on the merchant type. Travel businesses get extra time since customers book trips months out. But restaurant owners have to wrap everything up that same night. Hotels get sued all the time – they’re juggling reservations made six months ago alongside walk-ins who need a room tonight.

You need to settle these authorizations before they expire, or the bank won’t honor their promise to hold those funds. The card might get declined if you charge it after your window closes, even though the customer had money when they first swiped. And when something goes wrong later, the merchant has given up the right to fight fraudulent chargebacks – which is rough when you already have upset customers to manage.

The security laws around storing authorization codes are pretty intense. Merchants need particular encryption, can’t just save them anywhere, and payment processors will actually come check that everything’s done right. I’ve watched businesses get hit with penalties because they thought their standard business filing system was protected enough. It’s not.

Each card brand has its own differences too. With Visa, merchants can try again instantly after a card gets declined. But Mastercard makes you wait a full day before you can retry. They have completely different policies for subscriptions and recurring payments. And these policies change every few months – tracking what changed and when needs its own spreadsheet.

When businesses botch their authorization timing, the situation snowballs fast. Sales get lost because cards won’t process, the payment processor starts watching like a hawk, and suddenly higher fees appear on every transaction. Accounts can get their standard limits slashed because they kept letting authorizations expire.

Frequently Asked Questions

What's the difference between authorization and authentication?

Authorization and authentication in payment processing - a lot of merchants confuse these. They actually do completely different jobs. Authorization checks if a customer has enough money in their account. Authentication verifies that the person who uses the card actually owns it.

Authorization happens behind the scenes. Your payment system pings the bank and within a couple seconds you get a yes or no. Authentication is different - it needs the customer to prove who they are. It could be a PIN entry, a signature, or a fingerprint on their phone. Those signature pads where customers just draw a squiggle are useless - no one even looks at those anymore.

The combination makes a difference for security. A thief could steal your card information and authorization would go through fine - there's money in your account, after all. But if you add authentication, they don't have your PIN or fingerprint and the whole transaction gets blocked.

A merchant recently started requiring authentication on anything over $100. Their fraud chargebacks dropped by almost three-quarters. Most businesses prioritize authorization since it's automatic and prevents payments from declining. But authentication for bigger purchases is always worth it. Customers might need to take an extra second to verify.

How long do authorization holds last?

Authorization holds stay active for about three to seven days in my experience. But it can depend on which card network and what type of business you run. Hotels and car rentals are a whole different story - they sometimes hold for nearly a month because they need to cover themselves if a guest empties the minibar or brings the car back with a dent. Gas stations usually let go of holds within a day or so. They just need to know you have enough to pay for the fuel you're pumping.

Here's something that happens all the time - if that hold expires before actually processing the payment, you're out of luck. The bank gives the customer their money back and you have to start from scratch with a new authorization. When chargebacks come up, this turns into a headache because you can't show the customer actually approved that transaction at that exact time - this documentation issue comes up way too much.

Every industry seems to have its own way of doing it. Restaurants will bump up their first authorization by about 20% to leave room for tips, and subscription businesses usually skip holds and just charge the card straight away. You can work with your processor to adjust how long holds last for your situation. But the longer their money is held, the more likely they are to call and complain about it. There was a merchant whose customers kept seeing the hold and the charge show up separately in their banking apps. Half of them thought they were being charged twice.

Quick payment processing within a day or two makes everyone happy. Lately customers are always on their phones to check their bank balances, so the quicker everything can be settled, the fewer confused calls your support team has to field.

What happens if an authorization is declined?

I've seen merchants get burned when they run cards over and over after customers swear they have money. What usually happens is after three failed attempts in a row, the processor starts to look at your account sideways. Fraud alerts and chargebacks follow.

Some declines happen because the bank's servers are down or the customer hit their spending limit. These transactions usually go through fine if you wait until tomorrow. But if the card's expired or the account's closed, you're wasting everyone's time if you try again.

When this happens, tell customers their bank declined it and they should call them. Also make sure that you can take other forms of payment - this has saved a lot of sales over the years. Don't pretend it's a problem with your system when it isn't. The customer's going to call their bank anyway and when they find out what actually happened, you look either dishonest or clueless. It's better to be straight with them - they actually respect honesty and will keep shopping with you.

Requirements & Timeframes

Payment approvals used to seem like a safety net - once you had that approval, you were set to go. But that's not how it works. Business owners are always taken aback when they find out that green light on a transaction means almost nothing if a customer decides to dispute it later. They can come back months after the fact and suddenly you have to deal with a chargeback.

The cost to businesses is staggering. You do everything right (follow the laws, get authorization, ship with tracking) and customers can still claim they never got their order. Or they'll say it wasn't what they ordered. Or they just forgot they bought something. They see some company name on their credit card statement that doesn't match the website they shopped on and boom, they're calling their bank. Recent numbers show businesses losing 1-2% to disputes. On a million in sales, that's ten or twenty thousand dollars just gone. The payment approval is worthless in these cases.

Since around 2020, there's been more of what the industry calls "friendly fraud" - customers disputing charges they actually made. Up maybe 40% based on latest data. Customers have so many subscriptions and online purchases now they legitimately don't remember half of them. When "XYZ Corp LLC" shows up instead of the brand name they know, their first instinct is to dispute it. Business owners have to save everything - order confirmations, shipping info, any emails back and forth. Documentation like that means that you'll win maybe 7 out of 10 disputes if you're actually in the right.

You need knowledge of how payments actually work - like when funds settle for real, how long customers have to dispute, what authorization holds mean - because it matters for selling online. I tell business owners to just factor dispute losses into their prices from day one. It's not going away, so you might as well plan for it.

Call (844) NO-DISPUTES

Call (844) NO-DISPUTES